Working out public holiday pay can be a chore and there may be a way to make it an easier process than you think.

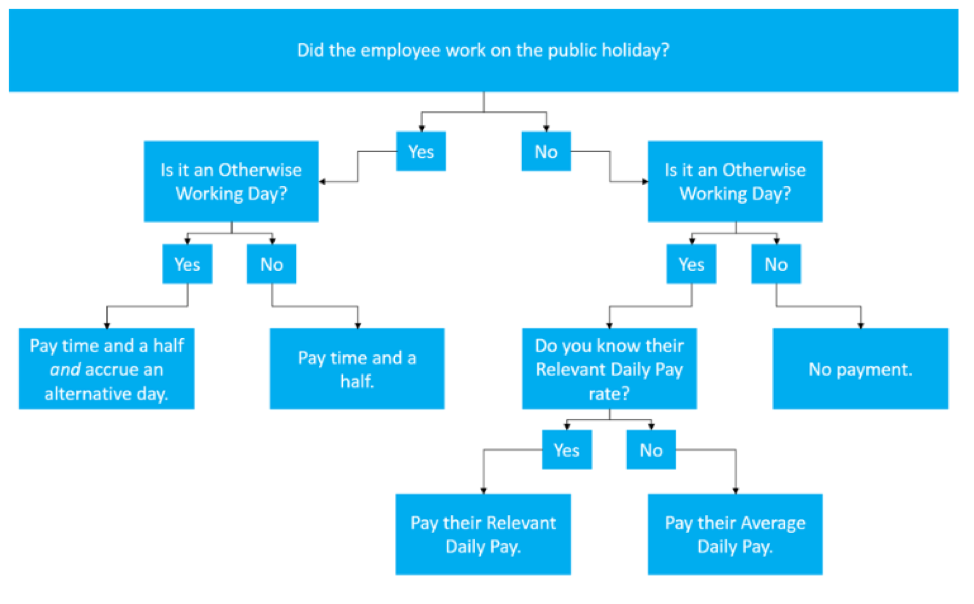

The flowchart below is a great place to start and if you follow the boxes your task will be much more straightforward.

The chart refers to some terms that you need to understand.

(Flowchart credits PayHero: https://support.payhero.co.nz/hc/en-us/articles/360002749915-Public-Holidays)

Otherwise Working Day (OWD)

In most cases the otherwise working day is easy to work out as if it had not been a public holiday or the employee had not been unwell and stayed at home or on bereavement leave, they would have been working.

Sometimes it is not so clear, with rosters and shift work. In these cases, agreement should be reached by looking at the employee’s usual work patterns or what the employment agreement says.

If a public holiday falls during a closedown period – again if an employee would otherwise have had a working day on the public holiday it is an ‘otherwise working day’.

It is against the law to take an employee off a roster on a public holiday when it is an ‘otherwise working day’ to avoid holiday entitlements.

Relevant Daily Pay Rate (RDP)

This is the regular pay rate as if the employee were at work on that day.

It includes regular taxable allowances, commission and bonuses as if the employee would have received them as normal on that day – also overtime payments or the cash value of accommodation if provided.

Relevant daily pay does not include any payments that would not have normally been made on the day they are on leave or holiday, or reimbursement payable for items that may have been used had the employee been at work.

Average Daily Pay (ADP)

This can only be used where RDP is not possible or practicable to calculate or if an employee’s daily pay varies in the pay period in question.

It is calculated by adding an employee’s gross earnings for the period and dividing this by the number of whole or part days worked or paid leave or holidays during that period.

Alternative Holiday

When your employee had to work on a public holiday, that would otherwise be a working day for them, an alternative holiday is granted to give them a day off at another time. The alternative holiday is a full day off work, regardless of how many hours they worked on the public holiday and is paid at their normal full relevant daily pay rate.

An alternative holiday is also given if the employee is required to be ‘on call’ on a public holiday that is otherwise a working day for them as they have been required to limit activities and have not had a full holiday. But they are not entitled to this day if they are not required to limit activities and were not called to work.

If an employee works on a public holiday that would not otherwise be a working day for them they are not entitled to an alternative holiday, but they are entitled to at least the time and a half pay for the hours they work. The same applies if an employee is employed to only work on public holidays.

The Alternative Holiday day off is agreed with the employee and is not another public holiday but is a day that would otherwise be a working day for them. If it cannot be agreed the employer can decide but it must be reasonable and at least 14 days’ notice must be given to the employee

An employee can ask for an alternative holiday to be paid out if 12 months has passed since entitlement and the day has not yet been taken as a holiday. Alternative holidays do not expire and can be paid out in their final pay.

There are complexities to leave, holiday entitlements and pay rates that can be time consuming for an employer – good software, and an intermediary service provider can reduce this ‘time spent’ to nil and provide an accurate and stress-free payroll service.

NEED HELP ON PAYROLL?

Don’t hesitate to ask questions! Email payroll specialists directly admin@flexipayroll.co.nz or call at 0800 88 70 70.

You can also go to FlexiPayroll Website for more info.